Viewing And Changing Payroll Projection Dates

Content

These entries must be processed on or before your last payroll of the year to ensure that your Form 941 and W-2 reports are accurate. Terminated employees, who are registered on EA, can access, view and download their pay and tax statements. They also have the option to select and receive paperless W-2 tax statements.

- The calculations can be done manually or you can automate the process using a payroll service provider.

- Then click “Enter Paydata” and select “Paydata” from the popup menu.

- Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your employees or a court order.

- Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements.

- To use ADP for payroll, start by making a new payroll cycle to clear out any old data.

- Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar.

Services beyond payroll may take longer to set up. Regardless, a well-done transition should never disrupt your payroll process. Add additional checks for bonuses, commissions, retroactive pay or advance pay. Select the employee for whom you want to create the additional check. Information for that employee’s regular pay for this pay period is already entered. Now, enter a second row for that employee to create a new check. Click on “insert” and select “new row.” A second row will appear with the same employee name.

Your place of business and where your employees perform services also play a factor in payroll deductions because not every state collects income tax. How quickly you switch to your new provider depends on your company’s priorities, the services you’re using and how quickly you can access the required data. With ADP, some customers can be up and running within 2 days, while others choose to make the transition over a period of weeks.

Help & Support

To change the company code, click on the magnifying glass icon and select the correct company code.If you don’t have more than one company, do nothing. This step clears out all of the data from the previous pay period. Then, it advances the system to the new pay period.Go to the payroll cycle page. There are many different payroll software companies you can use to process payroll but ADP does an exceptional job at helping your company process payroll.

This offers considerable cost savings because the premiums can be withheld from their wages on a pre-tax basis under a Section 125 plan. In actuality, however, employees are not paying for their health coverage directly, but are reimbursing their employer, who submits payment to the health insurance provider. Some employees may also be subject to Additional Medicare tax. Starting with the pay period in which an individual’s earnings exceed $200,000, you must begin deducting 0.9% from his or her wages until the end of the year. Additional Medical Tax also applies to certain levels of railroad retirement compensation and self-employment income. Types of pretax deductions include, but are not limited to, health insurance, group-term life insurance and retirement plans. And while employees are not required to participate, it’s often in their best interest to do so.

The system will automatically calculate the gross salary, deductions and net salary for the pay period. Click on the “save” button frequently to save data you have entered. When you are done, click on the “done” button.Enter the number of overtime hours in the “O/T Earnings” column. Be sure to report any changes with your first payroll of 2021.

If you change the projection start date for the current pay period, you must re-run any exports or reports that had already been run for the period. Wait several minutes to allow new projections to be generated based on the new projection settings, and then re-run your exports and reports. If your employees are unionized, they’ll likely have to pay for their membership and any taxable benefits offered through the union. Other types of job expenses that can be deducted from payroll include uniforms, meals and travel. Some states, however, may prohibit these kinds of deductions.

How Are Payroll Deductions Reported?

Sick pay should be included on either the employees’ W-2s or on a separate form provided by the third party. If third party sick pay is not reported by the third party, it must be included on your employees’ W-2s. It is important that you obtain this information from the appropriate third party provider as soon as possible.

Your company may employ salaried employees or hourly employees who work a fixed number of hours each pay period. Work with an ADP representative to set up Automatic Pay for these employees. This way, you won’t have to enter their pay data each pay period.You can make changes to an employee’s salary or number of hours any time you need to. The long-term disability deduction covers a percentage of wages for employees who are injured or too sick to work for an extended period of time. When LTD is deducted pre-tax, employees pay slightly less for premiums, but are charged federal income tax on any benefits received. Post-tax LTD deductions, on the other hand, result in employees receiving slightly less take home pay each pay period, but their benefits aren’t subject to any further tax if they use them.

Service & Support

Also, the “Start New Cycle” button is green once again. This is the process for entering data for your salaried and hourly employees who are not set up for Automatic Pay. You enter paydata in batches, which are groups of employees.

Pretax contributions can save them considerable money compared to what they would pay for benefits and other services post-tax. To add or change the employee’s payroll company code,click the button next to the Payroll Company Code field then select the appropriate payroll company code. You can see that the payroll for this pay period was accepted.

To use ADP for payroll, start by making a new payroll cycle to clear out any old data. Once the popup window closes and the new payroll cycle page returns, you can set up the employees who are to be paid by clicking on “Process” in the task bar. Then click “Enter Paydata” and select “Paydata” from the popup menu. Select the employee or batch of employees and click “Go to Payroll Cycle.” You can now enter information such as the employees’ hours and any overtime, deductions and leave entitlements. Payroll deductions are generally processed each pay period based on the applicable tax laws and withholding information supplied by your employees or a court order. The calculations can be done manually or you can automate the process using a payroll service provider. Many businesses choose automation because it reduces errors and ensures that payments are filed with the proper authorities on time.

Map each payroll expense item in ADP RUN to an account on your QuickBooks Chart of Accounts. ADP RUN General Ledger also lets you choose whether you want to export payroll entries as a single entry for all employees, or as individual entries for each employee. If you select the latter, you can customize the mapping for each individual employee to different accounts. This is super helpful for clients with more complex reporting needs. Before you report costs in the payroll platform, you must first calculate the taxable portion of coverage that exceeds $50,000. To determine this amount, please review Publication 15-B, The Employer’s Tax Guide to Fringe Benefits , as prepared by the IRS, or speak with your company’s accountant. To help ensure W-2s are accurate for your employees, you should report Group Term Life Insurance in the RUN Powered by ADP® /Payroll Plus® platform PRIOR to running your final payroll of the year.

Now you can enter paydata for the additional check.Enter the tax frequency information, which calculates taxes based on the type of pay. For example, bonuses are taxed at different rates than regular pay. A popup window will appear that displays dates and deduction information for the upcoming pay period. Verify the week number, pay date and period end date. If you need to change any of this information, click on “Change Starting Week” to update it. Also, verify the scheduled deductions and special effects for the pay period. If all of this data is correct, click “Continue” in the bottom left-hand corner of the window.

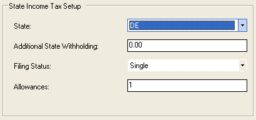

Input the appropriate salary information in the paydata grid. This will override the Automatic Pay for the employee for this pay period. As an administrator, you can change the date on which payroll projection begins for a pay cycle. When a holiday or other company closure occurs near the end of a particular pay cycle, you can override the regularly scheduled projection start date for that particular pay period only. If you need to change the interval between the start of projection and the end of the pay period for every pay period, you can adjust the “Number of Days to Project” setting. As a practitioner, you can change the date on which payroll projection begins for a pay cycle. Hours.” Enter the number of regular hours each employee worked.

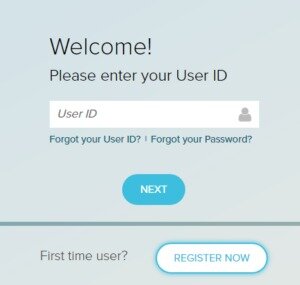

Short-term disability is often taxed in the same manner. As an accounting professional, how can I switch my clients to ADP payroll? To sign up or login, visit adp.com/accountantconnect. After you login, select “refer a client”, enter your client’s information and your dedicated ADP Representative will reach out to begin the process. The system keeps salary and tax data for each employee and automatically calculates this information based on the number of hours you input. Also, employees set up for Automatic Pay automatically receive a paycheck. However, sometimes you need to make one-time changes.

SSNs and TINs will now be truncated on copies of Forms W-2, 1099-MISC and 1099-NEC. This includes copies that are provided to employees to report third party sick pay and group-term life insurance. If you identified a specific payroll projection date for a particular pay period, that projection date will not change unless you manually select another specific date for that pay period.

Before Your First Payroll Of 2021

You can use previously-created batches, or you can create and customize new batches.Click on “Process” in the task bar at the top of the page. In the pop-up menu, under “Payroll,” select “Payroll Cycle.” You will be directed to the Payroll Cycle page. If your business has more than one company that processes payroll, confirm the correct company code.

To view the payroll projection schedule for a pay cycle in a calendar, click the button to the left of the pay cycle name. The Projected Pay Cycle Calendar page displays a calendar that begins with the current pay cycle and shows the projection start date and the pay period end date for each pay cycle in view. The calendar also displays all holidays assigned to the pay groups associated with the pay cycle. Many Americans who have health insurance purchase it through their employers via payroll deductions.